Unsustainable UK - Spurring Growth, Superpowers and the Financial Markets

Dreaming of being a sustainable superpower whilst running off a cliff. Not sustainable.

Britain is no longer a rich country1, but don’t worry its going to be a SUPERPOWER.

Apparently not just “a” superpower, but the UK is going to stand tall amongst giants in AI, defense, wind-power, clean energy, science and even shipbuilding - and probably others I have missed. Promises made repeatedly by politicians of all parties as well as by compliant media. The worst part is the manic belief that being a world leader in Net Zero will enable the other aspirations to manifest - when all the evidence points to the exact opposite. Net Zero is increasing the cost of energy2 in the UK - undermining any hope of “growth”.

Both parties acknowledge the perilous state of the UK’s finances, both recognize the need for “growth”. The financial markets don’t believe party has a viable solution.

In September 2022, Liz Truss and Kwasi Kwarteng unveiled a Thatcherite mini-budget slashing taxes by £45 billion to ignite growth, but markets recoiled, sending gilt yields soaring by 0.5 percentage points in a day, the pound to a record low against the dollar, and borrowing costs up, with the Resolution Foundation estimating a £30 billion fiscal hit.

In contrast, currently Keir Starmer and Rachel Reeves are desperately trying to create investment-led growth with £70 billion in extra annual spending. Unfortunately, they are simultaneously failing to cut day-to-day budgets while borrowing £113 billion, which is sparking market unease: 10-year bond yields rose to 4.48% post-Budget and the pound fell 0.8%, with the OBR 3warning of tight fiscal headroom and rising debt risks.

Casting around for "growth" like this, whether through unfunded tax cuts or borrowing binges, resembles a gambler chasing the elusive “big-one”. The UK got lucky once before. However, a strong economy and the consequent societal wealth comes from cheap and reliable energy. Betting on expensive and unreliable energy seems like poor odds at a difficult time.

The Escalating Death Spiral: UK's Unsustainable Finances in 2025

Three years ago, in my 2022 Substack post "Notes on a Death Spiral," I likened the UK's economic crisis to the anime Death Note, where politicians wielded life-or-death power over the nation's finances through policy inaction. Back then, the trigger was the global gas price spike caused by Russia’s invasion of Ukraine.

Today, July 2025, that spiral hasn't just continued, it's accelerated, despite gas prices being significantly lower4.

Despite a change in government, persistent high debt, delusional growth ambitions, and an unyielding commitment to Net Zero are hurtling the UK toward a 1970s-style currency run, potential debt default, and why not? an IMF bailout.

There is a terrible irony that by aspiring to be a “world leader” in Net Zero a country ends-up up insignificant and ignored due to a lack of economic (and military) strength (A Conceit At The Table).

The Unsustainable Economy: Key Indicators

The UK's fiscal foundations are under pressure. The most obvious of which is £2.7 trillion of debt, which is costing over £100 billion in annual interest (UK Parliament Publication Jan 2025). For contrast, the UK’s entire defense budget was c. £54 billion in 2024, The eye-watering £2.7 trillion is almost exactly 100% of GDP, and doesn’t include massive unfunded pension obligations.

Trillions are hard to visualize - but if each pound was one second then from the time of writing this post (July 14, 2025)

2.7 million: ~June 13, 2025

2.7 billion: ~November 1939

2.7 trillion: ~83,591 BCE

Two point seven trillion is a very big number.

In a strong and growing economy, the debt-to-GDP ratio would decrease and the ability to service debt would improve. Ideally, running a fiscal surplus would allow for reduction in the total debt.

No wonder that politicians from Margaret Thatcher to Liz Truss to Rachael Reeves want to “spur growth”.

The Economic Fatal Trifecta5

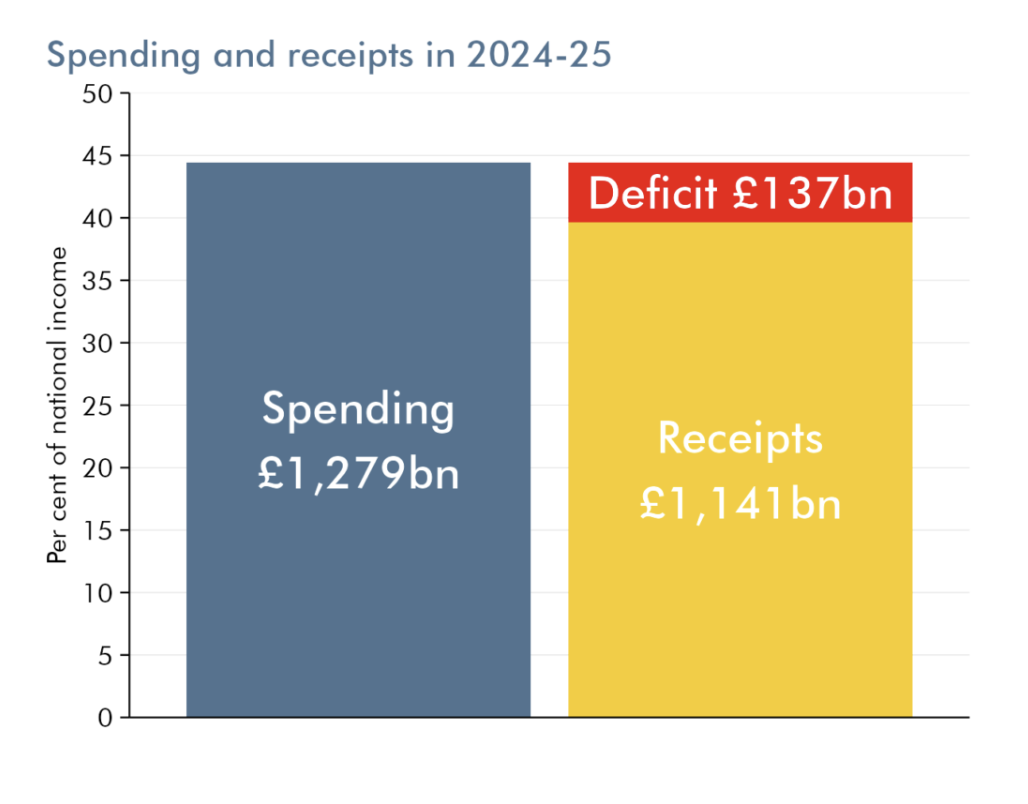

When a government's expenditure exceeds its revenue, it incurs a deficit, necessitating one of three responses: cutting spending, increasing revenue, or expanding borrowing - just like a household or corporate budget. However, a "Fatal Trifecta" emerges when all three options are constrained, as is increasingly evident in the UK's fiscal crisis.

Raising revenue through higher taxes faces social and economic limits6: excessive taxation stifles growth, and there are clear social limits to public tolerance. An export-led trade surplus could theoretically boost receipts at constant tax rates, but the UK's persistent trade deficits, deindustrialization and uncompetitive energy costs render this unlikely.

Cutting spending is politically fraught; successive governments prioritize visible benefits like welfare over critical but less salient expenditures such as infrastructure maintenance, despite social tensions over perceived over-generosity in certain areas.

Borrowing. Meanwhile, the UK has little capacity to increase borrowing because this would elevate credit risk and trigger higher borrowing costs, as evidenced by rising 10-year bond yields (4.48% post-2025 Budget).

Unlike households, sovereign states can expand the money supply, but this risks currency devaluation, escalating the cost of imports, (ironically including energy), and worsening the fiscal deficit through inflationary pressures.

At a time when all options are unpalatable, cutting the revenue generating Oil and Gas industry as well as attacks on the farming sector seem impossibly badly judged.

Policy Missteps

Liz Truss's 2022 mini-budget was a desperate recognition that "something" needed to change. Her tax cuts aimed to spur growth amid the energy crisis, but markets rebelled - tax cuts would reduce revenues, making the repayment of loans more risky. The promise of growth did not outweigh the real unfunded tax cuts - triggering a bond sell-off and pension chaos that forced reversal.

Enter Labour in 2024, promising fiscal prudence but delivering more of the same—albeit with a zealous green tint. The 2025 spending review hints at tax rises on capital gains and inheritance to fund uncut departmental spending (up 2.3% in real terms overall, though some areas face austerity), alongside £113 billion in borrowing for capital projects to… spur growth.

Growth rhetoric abounds: Prime Minister Keir Starmer's January 2025 AI Opportunities Action Plan vows to "turbocharge" AI, increasing public AI computing power 20-fold by 2030 and deploying it across sectors to boost productivity by 1.5% annually—potentially adding £47 billion to the economy. Starmer calls it "mainlining AI into the UK's veins," positioning Britain as an AI superpower.

This is delusional. How can the UK become an AI leader when its electricity, vital for energy-hungry data centers, is among the priciest globally? Likewise, defense/ manufacturing/shipbuilding in an era of deindustrialization is, at best, unlikely. Worst of all, the idea that anywhere could become an energy superpower based on “clean energy” is, again, for want of a better word, delusional. The physics is simply against it.

The ideological differences of the Truss mini-budget and the current Labour plans, can be caricatured as":

Unfunded tax cuts with the “hope” of spurring growth

vs.

Increased borrowing with the “hope” of spurring growth.

The markets don’t like either - and we need to ask why.

The Corner Shop

Online optimists counter: "A country isn't like a corner shop, it controls its money supply and can borrow indefinitely and sets its own interest rates."7 This nods to Modern Monetary Theory (MMT), but it's flawed. Yes, the UK prints pounds, but it doesn't fully control interest rates (Bank of England independence and markets dictate) or currency exchange rates. With modest borrowing and a strong economy, the government is in control.

But Thatcher's household analogy holds—governments aren't immune to market discipline. When you have a bad combination of (1) too much borrowing, (2) too much spending and (3) not enough income, two big (related) sticks are there to beat you.

The first is the same as a household - your credit score goes down, you are seen as a risk - thus any new borrowing - and critically refinancing of existing maturing debt (that you can’t pay back) - will cost more to reflect your lack of credit worthiness. In effect you have to offer higher returns to get anyone to lend you anything. In practical terms this means more money goes on interest payments and there is less for everything else, including “spurring growth”.

The second is that high debt and unsustainable spending weaken investor confidence, putting downward pressure on the currency - despite your high interest rates people don’t want to own your currency, so investors sell sterling-denominated assets, increasing currency depreciation pressure.

A falling currency stokes inflation in an import dominated currency, to control inflation you need… higher interest rates. Oh wait…..

Unsustainable and Depressing

Given these constraints, the UK faces a narrow set of outcomes (I acknowledge using AI for help with this section) , none of which are politically palatable or economically benign. Below are some plausible scenarios, their mechanisms, and implications:

1. Massive Austerity with Widespread Impoverishment

Mechanism: The government implements severe spending cuts, targeting welfare, public services (e.g., NHS, education), and infrastructure maintenance, as these are the largest budget items (£245 billion annually on welfare alone in 2022). This would require something to break the social barrier against cuts, likely external pressure (e.g., market panic or IMF conditions).

Likelihood: Low without external pressure (e.g., IMF bailout). Politicians avoid this due to electoral backlash, and current policy (2.3% real-terms spending rise in 2025) shows no appetite for deep cuts.

Political Feasibility: Near-impossible domestically. Only an external shock (e.g., bond market collapse) or IMF conditions, as in 1976, could force it.

2. More Borrowing Leading to Default or Currency Crash

Mechanism: The government continues borrowing (£113 billion planned for 2025 capital projects), ignoring market signals, to fund spending and growth initiatives (e.g., £14 billion AI plan). Markets react with higher yields or a bond sell-off, as in 2022, pushing the UK toward default (inability to service foreign-currency debt) or a currency crash (sterling devaluation).

Likelihood: High, given current policy. Labour’s borrowing plans and market sensitivity (post-Truss and 2025 yield spikes) suggest this is the default path. Politicians may favour this to delay pain, but markets react fast, as you noted, making it unsustainable.

Political Feasibility: Attractive short-term, as it postpones tough choices. Politicians might hope to exit before the crash, but bond markets’ speed (e.g., 2022’s rapid yield surge) limits this window.

3. Money Printing and Inflationary Spiral

Mechanism: With borrowing constrained, the Bank of England (BOE) expands the money supply (e.g., via quantitative easing) to finance deficits, which sovereign states can do. This avoids immediate default but fuels inflation and devaluation.

Likelihood: Moderate. The BOE resists overt monetization, but fiscal desperation could force its hand, especially if bond markets rebel.

Political Feasibility: Tempting as a covert way to delay crisis, but politically risky if inflation spirals visibly.

4. IMF Bailout with Imposed Austerity

Mechanism: A bond market crisis or currency crash forces the UK to seek an IMF bailout, as in 1976 ($3.9 billion loan). The IMF imposes strict conditions: deep spending cuts, tax reforms, and structural changes (e.g., abandoning Net Zero).

Likelihood: High if borrowing or currency crises materialize. Markets’ rapid reaction (e.g., 2022 Truss fallout) makes this plausible by 2027-30.

Political Feasibility: Unpalatable, as it admits failure. Politicians delay until forced by markets or external actors.

5. Radical Policy Shift (Unlikely Breakout)

Mechanism: A government defies political norms, abandons Net Zero and actively exploits the UKs remaining natural resources (oil, gas and even coal), cuts welfare aggressively, and reforms taxes to prioritize growth (e.g., slashing corporate rates). This breaks the trifecta by forcing spending cuts and betting on long-term recovery.

Likelihood: Very low. No current political will exists (Labour’s 2025 plans increase spending), and social resistance is formidable.

Political Feasibility: Near-impossible without a crisis forcing action or a populist shift.

My Predictions (no AI!)

No voluntary austerity (Scenario 1) of the scale required to stop the spiral - to do so would require the political class. and the public. to admit the dire situation.

Probable attempts to “kick the can down the road” - the UK will try more borrowing (S2) and/or money printing (S3) - both will lead to (S4) “Imposed Austerity”

Net Zero will get canned, but probably after too much damage has been done, the UK will try and resuscitate its North Sea oil and gas and ideally, nuclear(S5)

The UK will reopen coal mines at some point and really regret blowing up its functional but unloved coal-fired power stations. (S5)

Currency devaluation is most likely. Currently the currency is OK -partly because the USD has been weakening (due to its own massive debt load). Of the two, I’d bet on the USD long term8

IMF bail-out - second time’s the charm?

The UK is not the only country in this kind of situation, although it is one of the worst “big” economies. Countries that can break out of this cycle will need to be resource rich, or have direct access to cheap energy. Failing that, as many are now doing, cutting spending on Net Zero and on social costs (ideally on defense - but that ship has sailed) - and build out nuclear power for the next 80 years. A sliver of hope for the UK is that the nuclear strategy is not dead (despite Hinkley Point C).

Telegraph headline March 2025

Kathryn Porter - The True Affordability of Net Zero. Gordon Hughes (via Unherd) The True Cost of Net Zero. David Turver at EigenValues - Net Zero for Dummies

The argument that Net Zero reliance on wind and solar will reduce the UK’s exposure to global geopolitical price spikes has some (but not much) merit - I wrote about it here.

Apologies to Meredith Angwin for taking her bons mots out of context.

The Laffer Curve

An example of the MMT explanation that an economy is not like a household

This is absolutely not financial advice of any kind in any jursidiction. A personal opinion!

Excellent

To Pandreco:

In 2024, just after the new Labour Government took over, namely PM Starmer; Exchequer Reeves; Sec. for Energy Miliband; and especially Head of Mission Stark - who specifically asked for and received the information:

-- received and acknowledged receiving information that was extended without any strings attached, on a new "item" that could have both spurred the UK economy and helped drastically lower the cost of developing clean electricity to both the domestic / commercial / and industrial electric power user.

But - most likely because none of them are STEM educated, i.e., not one of them have a science based education - they turned to "whom-ever had an opinion" as to the actual merits of this new "item" - which was a solid-state electric power supply - that used the same circuitry, used the same way - as has been working as the "resonating receiver circuit" found in the billions of Radios manufactured after Nikola Tesla invented and US Patented the Radio in 1900 - and that's a lot of Radios.

It is very interesting that you bring up Liz Truss's mini budget -and also Margaret Thatcher here -- because it is exactly what Thatcher Government put into place throughout the UK, i.e., the 2-tier, both tiers "for profit" -- that this new solid-state electric power supply would have made redundant -- along with it's many layers of bureaucracy.

This is because this new power supply could be easily and very inexpensively mass produced:

--- in the UK;

--- for the UK electric power user;

--- and also for export to the World.

What your Government Leadership "passed on" -- because they either decided themselves in their uneducated fistate; or relied on people or academia who were also uneducated as to "electrical resonance" and it's capabilities, i.e.:

--- the demonstrated and documented ability of a specific resonating circuit to "electronically develop clean electricity to be installed either:

a.) "at" any new or existing "stationary" location,, i.e., any home; flat; office-space (per floor -per occupant); commercial; or industrial-site - including retrofitting-repowering all of the existing fuel burning / Atomic / or Hydro-powered high voltage electric power plants - and

b.) "in" any new or existing "movable" vehicle - be it battery or internal combustion engine powered - on land / in or on the seas / or in the air as a propeller; rotor; or hi-bypass jet powered private or commercial aircraft - making available

b1.) unlimited range of travel and or movement, and

b2.) unlimited time or travel and / or movement.

I offered your Labour Government the technology - as both a natural born American citizen - but also as a full-blooded Scotsman - going directly back to Rob Roy MacGregor --

--- because although your new Government had "promised to gold-plate the kitchen sink" - "they-had-nothing" as far as the ability to accomplish what they'd promised -- and I could make that item available to them.

I did so - because the US Government / all US Universities / and all US commercial interests contacted - had previously reacted the same way that your Labour Government did, i.e.:

--- they shielded the US / status-quo for profit / electric power development and distribution Industry:

--- while your Government is shielding your 2 tier / status-quo for profit / electric power development and distribution Industry.

Suffice it to say that the "system" is now fully privately funded- and is under development for mass production - elsewhere.

And here's the "kicker":

--- there are no Laws - in the Industrialized World - that restricts a private premises owner from deciding which electric power source will power that premises -- and this powef supply can take every site "totally off grid" -- because, again it develops clean electricity:

--- where needed per site;

--- as much as is needed per site;

--- for as long as is needed per site.

Thank you,

Scott McKie / The POD MOD Project

Fast