TL:DR

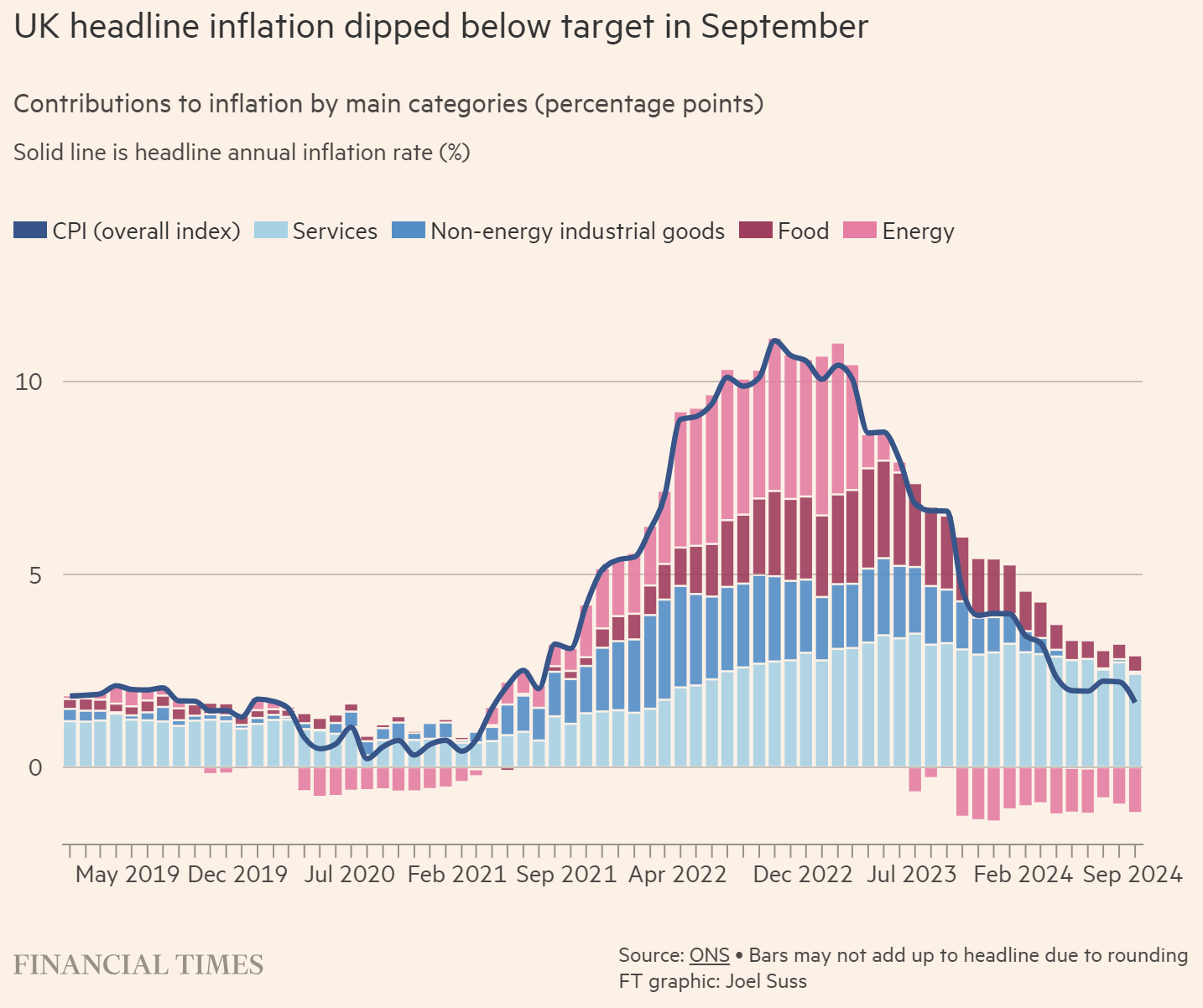

Inflation is down because energy (specifically) oil is cheap.

UK Electricity bills will be going up despite cheap oil and gas.

The UK needs gas for home heating and elecricity generation.

Gas is likely to get more expensive as AI gobbles up US supply.

The next energy-crisis in the UK is a question of “when”, not “if”.

We're on the one road

Maybe the wrong road

It's the road to fuck knows where

"Loyalty Song" Babyshambles. 2005

October 2024, it was reported that inflation in the UK has come down “more than expected”. I love this regular trope, the ever-present “more than”, or “less than expected”. Generally, this can be read as “new facts undermine our world-view, and we don’t like understand”.

Anyone with an ounce of energy experience could tell you that, with oil prices hovering at circa $70 (which is <$50 in 2014 real terms) and global gas prices much lower than 2022 (when they really were driving inflation up), inflation would be down. There are the direct costs as noted in the announcement; “petrol prices and airline tickets”, but also the less obvious and slower to react “embedded energy costs” in things like food - which use energy at every step from seed planting to the supermarket shelves, and in any form of manufacturing.

The price of petrol has come down because crude-oil is down, and the price of airline tickets are down because… yes you guessed it, fuel costs are down.

So to the surprise of many pundits, cheap oil is driving inflation down. This ought to be blindingly obvious, but it clearly isn't. One ray of hope is that Andrew Bailey the Govenor of the Bank of England, does understand this, and has warned that an oil-shock driven by conflict in the Middle East could drive up inflation in the UK (and it would be out of his control):

The Bank of England is monitoring the Middle East crisis amid fears that a worsening conflict between Iran and Israel will make it impossible to stabilise oil prices and leave the global economy vulnerable to a 1970s-style energy shock.

Andrew Bailey, the Bank’s governor, said he was watching developments “extremely closely” and that there were limits to what could be done to prevent the cost of crude rising if things “got really bad”. The Guardian

A Very British Tragedy

On the BBC’s World At One radio program, there was talk about how these lower inflation numbers are “a blip” and that there is an expectation that inflation will go up again. Why? Because “energy prices” are going up. Let’s assume they don't actually mean energy prices (unless they have some deep insight into the global commodities markets). They meant “electricity prices”.

And how do they know electricity prices are going up? Well, it's not because the usual trope of “electricity prices are set by the marginal cost of gas and gas is expensive”. That was true during the energy crisis of 2022-23 and will be true again at some point. But at the moment, rising electricity prices in the UK are not driven by global gas markets, which are very moderate. Au contraire, the cost is the energy transition.

These are often said to be transitory, “one-off” costs, as we build out the infrastructure. But they are not, they are systemic costs. So electricity prices are going up. We know they're going up even though gas is relatively cheap. Which leads to the painful next question what happens when gas becomes more expensive? And the corollary question: why will gas become more expensive?

The Next Gas Crisis for the UK

The UK’s gas production is in natural decline, and this is being accelerated by government policy. Despite all the wishful thinking, the UK is still heavily reliant on gas for heating and for electricity generation when wind and solar are absent. Cold winter nights, for example. Consequently, the UK is becoming increasingly exposed to global gas markets, whilst being told that energy security is a core objective.

As a general rule: the more LNG comes to market, the more people will find uses for it. This is the “M25 scenario”1, as I've written about previously. However, in addition to this natural “Induced Demand” we now have energy-hungry data-centres and the artificial intelligence they run. It is no small irony that the Tech behemoths who were at the forefront of Greenwashing - making all sorts of claims about being powered by 100% renewables - are now having to restate their Net Zero ambitions or simply not be able to compete in the AI arms race.

Ideally, the new data-centres would run off of 24/7 low-carbon renewables. In what must be a cognitive shock, they have found out that wind and solar don't work so well. In some cases, they are resorting to coal because that's what's available.

And what they have very cleverly worked out, because they are tech bros after all, is that nuclear provides very reliable, relatively cheap2 and very low carbon electricity. This is the most extraordinary revelation. It took the EU about ten years to work this out. Germany still hasn't quite worked it out, but it's getting there. At least public opinion has shifted, even if the German politicians haven't yet.

Contracts are being signed with SMRs and there have been a couple of very high profile announcements about existing power plants (like Three Mile Island) being brought back on-line. Despite the headlines, there is a problem of timing, AI induced energy demand is here and now, but:

SMRs don’t appear to be ready for market,

refurbishments are an unknown quantity and

new-builds potentially take a decade or more, even if permitting and so on is speeded up.

Also, there are some serious issues around a lack of human capacity and competence: which I will come back to with reference to nuclear and oil in a future post.

Simply plugging into the grid is not an option because the data centers will stress the grids risking blackouts and/or massive price increases, neither of which are acceptable to the public.

So if nuclear is unlikely to be fast enough, and they clearly don't want to use coal and they can't use the grid (however it is powered) - what is the solution?

Gas Expands To Fill The Available Space

One very obvious solution, which is natural gas. The US has an absolute shed-load3 of it; much of which is being exported by LNG. The question then becomes: what happens if US domestic consumption ramps up massively because of AI?

AI-related electricity demand is expected to translate to between 6 billion to 13 billion cubic feet of gas a day in the short term, Toby Rice, EQT’s chief executive officer, said Tuesday. That compares with current total US consumption of just over 100 billion cubic feet a day. BNN

Clearly this will mean less LNG going to the world market, which means prices will rise everywhere.

Hello, Europe. Hello UK.

Thus, whilst the UK may not have many data-centres, the UK is exposed to global LNG markets; increasingly so as it kills off the residual North Sea activity with taxes. The UK has shut coal generated electricity, and has nuclear power plants getting very long in the tooth. Consequently, the UK is becoming increasingly reliant upon gas. It is possible that “on average” annual gas demand will decrease. However, peak gas demand is in the northern hemisphere winter, which is exactly the same time that everybody else is going to be very heavily reliant on gas. So the UK will be competing with countries which are (a) allies and (b) potentially much richer. Last time that happened the government had to step in with “energy support policies” which rose to 2% of GDP.

Initial outturn data shows that the total net cost of energy support policies in 2022-23 was £51.1 billion in 2022-23 (2.0 per cent of GDP). This was £38.8 billion above our March 2022 forecast… (OBR).

These “support payments” (along with other European countries) contributed to the oh-so-ironic increase in actual subsidies4 for fossil fuels that so enrage Net Zero zealots.

A Rock and a Hard Place

If we have learned one thing from the new Labour government, it is that there isn’t any spare change down the back of the sofa. So a global LNG price surge from AI in the US will hurt badly. Recall that 2% of GDP is the NATO objective for defence spending - so it is not a small amount. As Rachel Reeves is discovering - there is no Magic Money Tree: finances require trade-offs between income and spending.

A massive energy bill in the middle of trying to balance these books would be catastrophic. Taxation hits the Laffer Curve limit, spending-cuts create social unrest, and printing (borrowing) money weakens the currency - which is a bugger if you are importing Dollar-denominated gas or Euro-denominated electricity.

In the spirit of balance, it is worth noting that this is exactly the argument that Ed Milliband has used to justify the massive planned ramp-up in renewables - and as I have argued this does have some merit for energy security.

However, having more renewables doesn’t “solve” for energy affordability: it swaps the boom and bust of global commodity markets for systematically more expensive energy. It is hard to quantify that trade-off - and only time will tell. But this either/or point of view ignores the “third-way”: that of maximizing the use of resources in the North Sea to soften the blow of global markets.

It will take one cold winter in the Northern Hemisphere combined with reduced supply as AI gobbles up US natural gas, for the next “energy crisis” to hit the UK - something the UK can ill afford.

The concept of “Induced Demand” is that creating valuable infrastructure creates demand. Traffic surveys of potential demand for new roads (like the London orbital motorway, the M25), vastly underestimated the volume of traffic - because they did not account for all the journeys that would be created because the road existed….

The cost of nuclear can be made to look bad by citing examples of “one-off” construction especially when using experimental designs (Hinkley Point, UK) rather than the cookie-cutter approach used to build en-masse in France and S Korea etc.

“shedload” should be an SI unit

These are real subsidies to consumers, usually dominated by cheap petrol in places like Venezuela - and nothing to do with the imaginary subsidies that producers are accused of receiving…

Most traditional economists (and every loudmouth energy pundit) seems to be oblivious to the effect that the price of crude oil has a large impact on inflation.

Ya'll need to dump those anti-fracking laws in Europe. The gas is literally under your feet.