What is Wealth? Part 1: "The Toil and Trouble"

Wealth: maybe not what you think and certainly isn't money.

What is Wealth?

Is this going to be a feel-good post telling you that real wealth is friends, family and health?

Forget GDP and get with GNH instead (the Gross National Happiness Index)?

Has Energy IQ gone all hippy?

In short, “No”, and there are plenty of such posts for you to enjoy; they will undoubtedly be far more widely read.

This series of posts is about the kind of wealth that sustains life, separates us from the harshness of nature, and enables a comfortable and resilient society.

What Gives Money Value?

About a year ago a Twitter thread asked “what gives money value” - and the answers were very varied, ranging from:

funny/serious “10 Nimitz-class aircraft carriers”,

to taciturn “Trust” (said Jordan Peterson),

to plain odd… “the government”, (odd because destroying the value of money seems to be modus operandi of most modern governments).

In a time of increasing inflation - the question is a good one and was picked up and deep-dived by Joel Bowman at the Bonner Private Research substack (paywalled).

This is a very good read and gives a wide-ranging tour of how money came about, its “qualities” and how it has been viewed by economists from Smith to Marx. But ultimately I was left unsatisfied because the article goes 99% of the way, but then stops short (I suspect because the goal would appear to be arguing for the value of gold - something that is proving correct as fiat currencies, equities and bonds all take a hiding). But gold is also just another medium of exchange.

Toil and Trouble

What is the missing 1%? Before going there, let me borrow a couple of quotes from the same article used in getting to “Subjective Value Theory”:

“The real price of everything, what everything really costs to the man who wants to acquire it, is the toil and trouble of acquiring it.” Adam Smith

"Value is not intrinsic, it is not in things," the 20th century Austrian economist Ludwig von Mises argued in Human Action. "It is within us; it is the way in which man reacts to the conditions of his environment."

I’ll leave the philosophical aspects of this to others - but the key idea is money, any money or token of exchange, has value not because it is intrinsically bestowed… but is somehow context specific. In my world-view, money or any “token” is a placeholder that can get us our critical needs. In the most basic sense it can keep us alive but only when it can be swapped for “needs” like food, potable water. Energy makes getting food, potable water, shelter, and indeed safety, easier. It provides huge leverage when combined with modern machines. And to circle back and paraphrase Adam Smith - the value of something is the toil and trouble of acquiring it. How many of us have experienced real “toil” ? Not just playing at work, but toiling to survive?

In modern industrial societies toil and trouble are abstract - electricity comes out of a wall socket, food comes from the supermarket. No toil or trouble. A low price, and so a perception of limited value. It is important to note that despite very visible inflation in grocery and power bills, the price we pay is still very low.

It may not seem “cheap”, but keep in mind the context: you are not toiling in the fields or cutting firewood by hand 16 hours a day.

Specialization and Separation

“Who among men, dying of thirst in the middle of the desert, would not trade all the gold in the world for a drop of life-sustaining water?” (Also from Joel Bowman’s text). This is common example - substitute a backpack stuffed full of $100 dollar bills, gold bars or a bitcoin-wallet and the equation is the same. Neither gold, nor dollars nor bitcoin will keep you alive if stranded in a desert or on a remote island.

Returning to more normal conditions, whilst there is generally trust in the value of money it can be used as a medium of exchange - we do whatever work we are good at and we buy the goods and services we need. Modern life is characterised by extreme complexity and thus extreme specialization, divorcing us from the natural world.

This complexity makes it hard to see the role of energy underpinning life, we only see the money layer, not the food and energy foundations hidden below the shiny monetary floorboards.

Beyond Money: The Missing 1%

As discussed above, money is just a placeholder - money is a call on energy - because money will get exchanged for goods or services and thus will implicitly use energy. The modern capitalist system requires growth and it is equally clear that growth cannot be either infinite or exponential. Getting well outside of my comfort zone, but I have never seen good arguments for economic stasis or degrowth - what we have is a runaway call on resources in which the proverbial can is kicked down the road by increased debt. Again, this is the subject of fierce debate by bigger brains than me, but ultimately we should remember - you can print money but you can’t print resources/energy.1

[The first is ] The real economy of energy, labour, resources, goods and services. This real economy is a function of surplus energy.

The financial economy runs in parallel with the real one. Money has no intrinsic worth but possesses value only as a claim on the real economy.

Dr Tim Morgan (Surplus Energy Economics)

It is pretty well accepted that inflation is caused by the creation of money. The exchange rate of money-for-goods is a function of the amount of money that is available in society versus the amount of goods that are available at that time. You increase the amount of money, and prices increase if the supply of goods is constrained. If the supply is unconstrained you increase the amount of goods entering the economy and prices drop.

So far that is just classic Macro economics, but… “goods” don’t magically appear - everything has an embedded (or “embodied”) energy component.

The really odd thing is that economics doesn’t account for the role of energy in its underpinnings: Land, Labour and Capital2. One argument for this can be traced back to the early French economist Jean-Baptiste Say who noted that:

“Natural resources are infinite because, if they weren’t, we would not obtain them freely. Since they cannot be multiplied, nor exhausted, they cannot be the object of economic sciences.”

JB Say 1828 cited here

When energy is cheap, the Toil and Trouble of acquiring “stuff” is small and easily ignored. As energy becomes more expensive so the input cost will be harder to ignore.

Energy is Different

Life in all its wonderous forms is in some ways just a pitiless and ephemeral struggle against entropy. What keeps us alive are food, water, shelter, and safety - these are base rung of Maslow’s hierarchy of needs.

All these things we can now buy with money, and for many people there is a lot left over for other stuff. But as noted above, money is just a placeholder so we should be thinking about wealth, and specifically societal wealth.

That said, we all know that the economy is far more than just energy. Indeed we often hear that “energy is only 5% of the economy” with the implication that it is not that important. Which leads to the kind of thinking “OK, so energy costs have gone up, but hey, “its only 5% of the economy”….” - so what? Or indeed, “lets make everything more expensive with a Carbon Tax”. More on this in Part 4.

The minimizing of the role of energy belies the fact that every part of the economy uses energy, and as Jean-Marc Jancovici has pointed out, the brain is only about 2% of your body - but it would be incorrect to assume it is of marginal significance to the well being of the body. Likewise energy may only be 5% of the economy, but it enables the other 95%. Mess with the 5% and the rest will not carry on regardless. More on this in subsequent posts in this series. When energy is referred to as “the lifeblood” of the economy, it is not hyperbole.

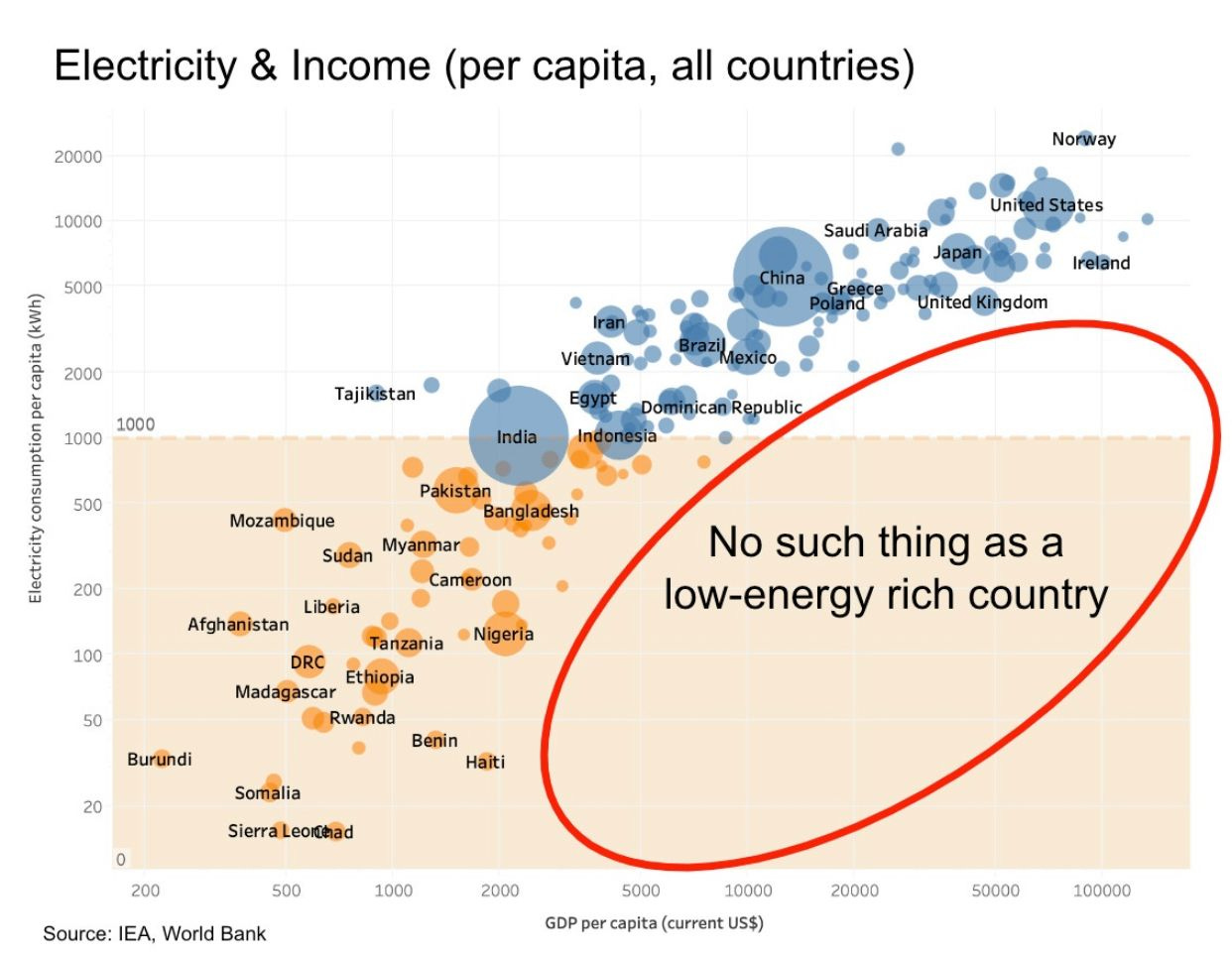

Electricity is a vector of high-quality energy, and access to electricity is a leading indicator of economic wealth. (The same plot can be found for oil use, and indeed overall “energy” use.)

Wealthy countries use more energy; but is this because wealthy countries can afford more energy or because judicious use of energy creates wealth?

In Part 2, I will build on the concept of the interdependence of wealth and energy and the importance beyond basic needs. I will look at how energy creates wealth, how wealth is much more than just the imperfect measure of GDP through the Human Development index, and how this might even inform us about the development of societal freedoms.

If “energy is the economy” and the economy allows us to flourish, then wealth is our ability to survive and flourish in the face of a natural world that would kill us.

Thus, a very simple logical conclusion is that as the real economy and the financial economy diverge, there will come a period of readjustment - which history would suggest is unfortunately one, or both, of hyperinflation or war.

logically it should be bundled in “Labour” as machines replace muscle power and Labour is a combination of wages to humans and the cost (capital and operational) of machines.

Excellent, as always.

The quest for energy is a quest for an abundant life. Mere gold won't do it. Spain imported immense amounts of gold from their colonies. It made them prosperous only temporarily.

Energy and productivity lead to real prosperity.