Last month there was a lot of noise about the BRICS countries coming together with a focus on the idea of creating an alternative to the USD for international trade. The increased weaponization of the USD and the financial system via SWIFT has made many countries understandably nervous. It is estimated that 80% of all international trade occurs in USD and that even for some of the remaining 20% once a bilateral deal has been consummated in local currencies, the holder will opt to swap into USD anyway because the next trade can’t be done using the newly banked local currency.

There are strong arguments as to why the hegemony of the USD will continue in at least the short term, despite the glaring issues around US debt.

In addition, arguments against a BRICS backed currency are legion. Not the least of which is that a BRICS currency would be dominated by the largest economy (China) and implicitly the other countries would be tied to Chinese economic ups and downs - losing much ability to manage their local needs. Currency controls in in key counties like India would have to removed as a precursor, and broad, aligned institutions set up.

Euro or no?

Which begs the question that if setting up a new alternative to the USD is going to be very hard and slow, why not use the Euro?

In fact the question that comes to mind is more general - why have I not seen any discussion of the Euro in this context? I get that the BRICS countries would prefer to have their own currency - as a matter of ego it has merit. However, in the face of a BRICS currency being very unlikely in the short term, yet having an existential loathing of dependence on the USD, surely the Euro deserves some consideration, despite being part of “the West”?

My guess is that it is a combination of politics and economics. Politically the Euro is seen as being not that different from the USD in terms of potential for political misuse. However, and in addition, the economic argument to NOT hold Euros is strong.

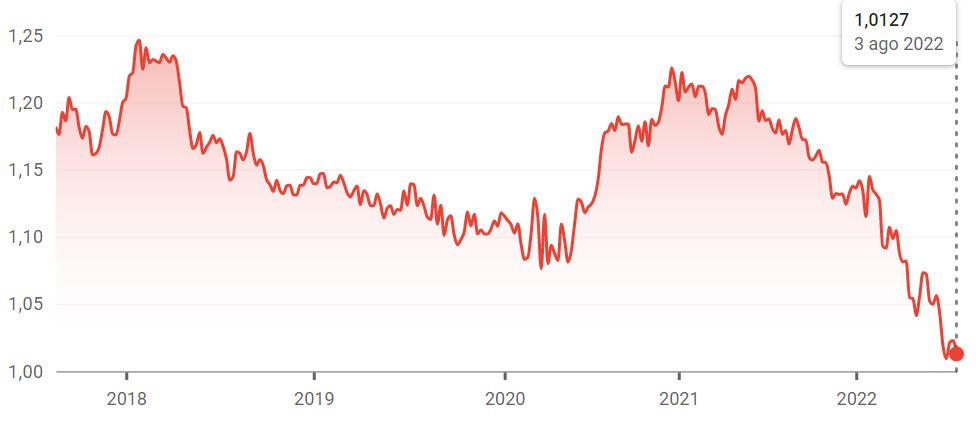

Europe (the EU) has a weakening economy. This is because it does not have a sound economic policy, which in turn stems from a lack of sound energy policy; in fact the only thing Europe has is an unsound decarbonization policy. The deindustrialization of Germany is just starting, being driven by high energy prices - which are caused by its poor energy policy (and only accelerated by the Russian war in Ukraine). When Germany sneezes, Europe catches a cold. It is no coincidence that the Euro has been losing value against major currencies (notably the USD) as the scale of its industrial woes starts to become apparent. There is an evil irony that a weakening Euro makes the cost of importing energy even more expensive (sine it is denominated in USD generally).

Given the systemic (and growing) weakness of the European economy, it would be brave to hold too much of one’s foreign reserves in Euros. Maybe this is why it never seems to be considered - “the market” is simply taking a view that it is not a serious alternative to the USD for trade or value preservation.

Because Energy.

Whilst I am generally a big fan of Peter Zeihan’s views on geopolitics, I think his take on the expansion of the BRICS in August of 2023 is missing an important point. At the workshop on BRICS and the global order in Johannesburg in August 23, a “motley crew” of Iran, Saudi Arabia, the UAE, Egypt, Ethiopia and Argentina became new members of the BRICS group.

“I urge you to try and come up with a worse list of mid-tier countries to bring on if you want to expand your geopolitical influence.” (Peter Zeihan)

Sure, one can argue that bringing Argentina and Ethiopia into the club is not exactly news-worthy, but have a look at the first three

Iran, Saudi Arabia and UAE, add that to Brazil and Russia and we start to see some serious oil and gas production/reserves (Egypt is a minor O&G player). Iran has the second largest gas reserves in the world and significant oil. Indeed Iran is one of the few countries with potential to increase oil production (if sanctions are ever lifted). Likewise Saudi Arabia has the second largest oil reserves behind Venezuela, with a caveat that much of the Venezuelan oil is hard to extract heavy-oil. Saudi Arabia is clearly acting as the swing producer right now and having significant influence on price. The UAE is no minnow, having the world’s 7th largest oil reserves and 10th largest gas production.

Oil in Reserve

The current oil-price being managed by OPEC+ is clearly driving inflation in “the West”. Unless, that is, we choose to look at inflation of goods and services “without food or energy included”, which is a common (but entirely deceptive) trick. Acknowledging this is an important step in understanding that the financial economy of the West is not separate from the real economy of resources. Printing money has delayed the day of reckoning, at the same time making that future reckoning worse.

The proposed new BRICS currency has been discussed at length and the idea of having it backed by something - gold and some nebulous “crypto” have been mentioned - has resonated with those economists who understand that such a fiat currency would need something to create the trust and legitimacy that a currency requires. Since coming off the Gold Standard in the early 1970’s the dollar has been de facto backed by its hegemony in oil (the “petrodollar”) and the military that it has been able to afford.

Oil is far from a footnote of history, and the gathering of Iran, Saudi Arabia and the UAE into the BRICS club may well be a recognition of this. Far from being in secular decline, energy in the form of oil and gas may be seen as the peg for a new Reserve Currency. Indeed, we may see a convergence of OPEC and the BRICs++ if other countires follow Russia’s lead into OPEC+.

As to my question “whither the Euro?”, the answer is that Europe has no energy resources outside of Norway and a bit of wind and sun. So it is not wither (where is) the Europe, but rather Wither the Euro1.

No one is thinking about the Euro as a Reserve Currency because there is nothing of substance behind it - or rather there will be nothing of substance behind it when energy prices better reflect global scarcity. The Euro is weak and unsupported.

Finally to circle back to energy - whilst the lifeblood energy sources (oil, gas, coal) are denominated in international trade in USD - weakening of a local currency, whether it be the GBP, the EUR or any other, makes the cost of importing energy higher and further weakens the local economy. The fact that domestic intermittent wind and solar contribute to electricity supply ought to help, but these benefits do not outweigh the bigger problem. But that is a subject for a separate article.

wither means to shrivel or decay, while whither means to where or in what direction.

wind and solar are detrimental to stable electric grid.