Two key pieces of news this week

OPEC+ announce a voluntary reduction in oil supply with a view to propping up prices.

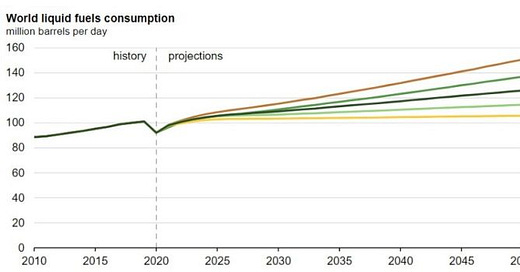

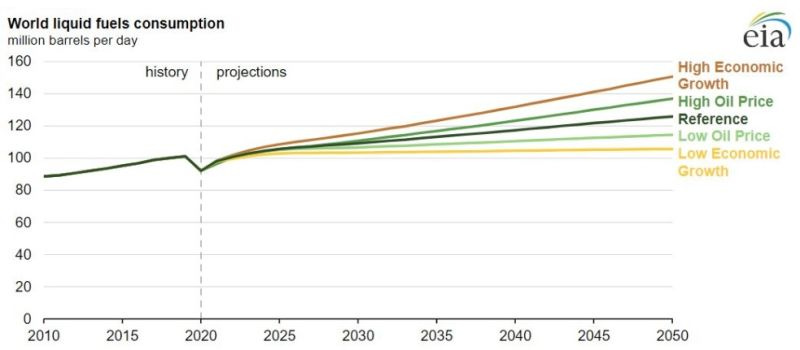

The EIA published flat-to-increasing projections of hydrocarbon liquid consumption through to 2050.

It appears that the OPEC+ announcement was triggered by the US administration reneging on their stated aim of refilling the SPR when oil got below a certain price. The implication of that “promise” was that the US SPR-refill would put a floor under the price of oil (which is always very sensitive to the marginal barrels around the supply/demand equilibrium). Without this, OPEC acted.

The EIA, which was set up after the 1970s oil price shocks to provide energy data to US administrations (rather like the original mandate of the IEA to the OECD). The EIA latest projections of future liquid fuel consumption shows no decline through to 2050. Whilst this may shock many people, and indeed many will simply not give it any credence, just stick with it for a very simple analysis.

The indisputable part of this is our starting point, which is roughly 100million barrels per day. It is a big number for sure but just how much oil is represented by these scenarios? What is 100million barrels a day for the next 22 years?

100million barrels per day, every day is 100m*365.

Multiply by 22 years.

I get to 803 Billion Barrels, in a flat scenario.

is that a lot?

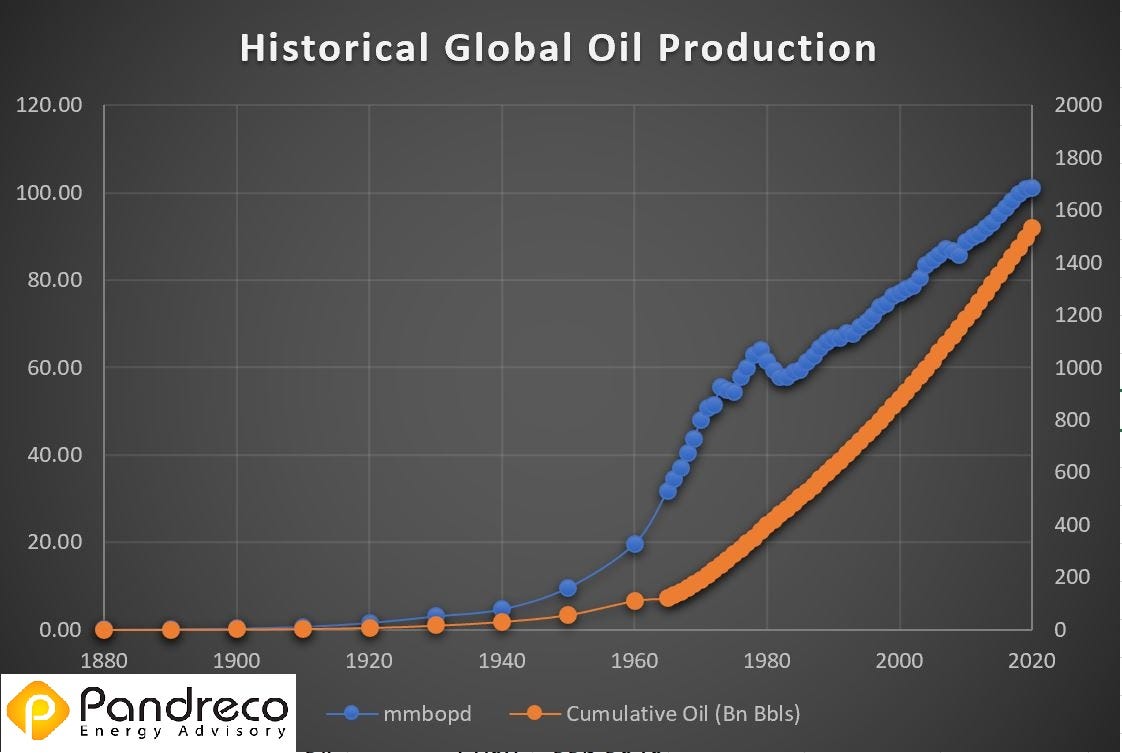

Since 1859 and the first rotary-drilled well in Pennsylvania, the world has consumed roughly 1,600 Bn barrels.

Roughly 750Bn of that total was produced and consumed in just the period 2000-2020.

Thus, working from the EIA projections we will need 50% of all the oil ever produced, in just the next two decades. Note that I looked at this a couple of years ago - and did the same calculation based off the BP “Rapid Transition Scenario” and I got to a number north of 700Bn barrels - even in a rapid transition scenario.

And as an important reminder - existing fields are depleting, the big ones are mature and super-mature.

The industry has been very efficient at exploration - there are no doubt some great surprises out there (Guyana and Namibia are recent examples, and there will be others) - but these represent a drop in the ocean (an unfortunate turn of phrase, I'll admit).

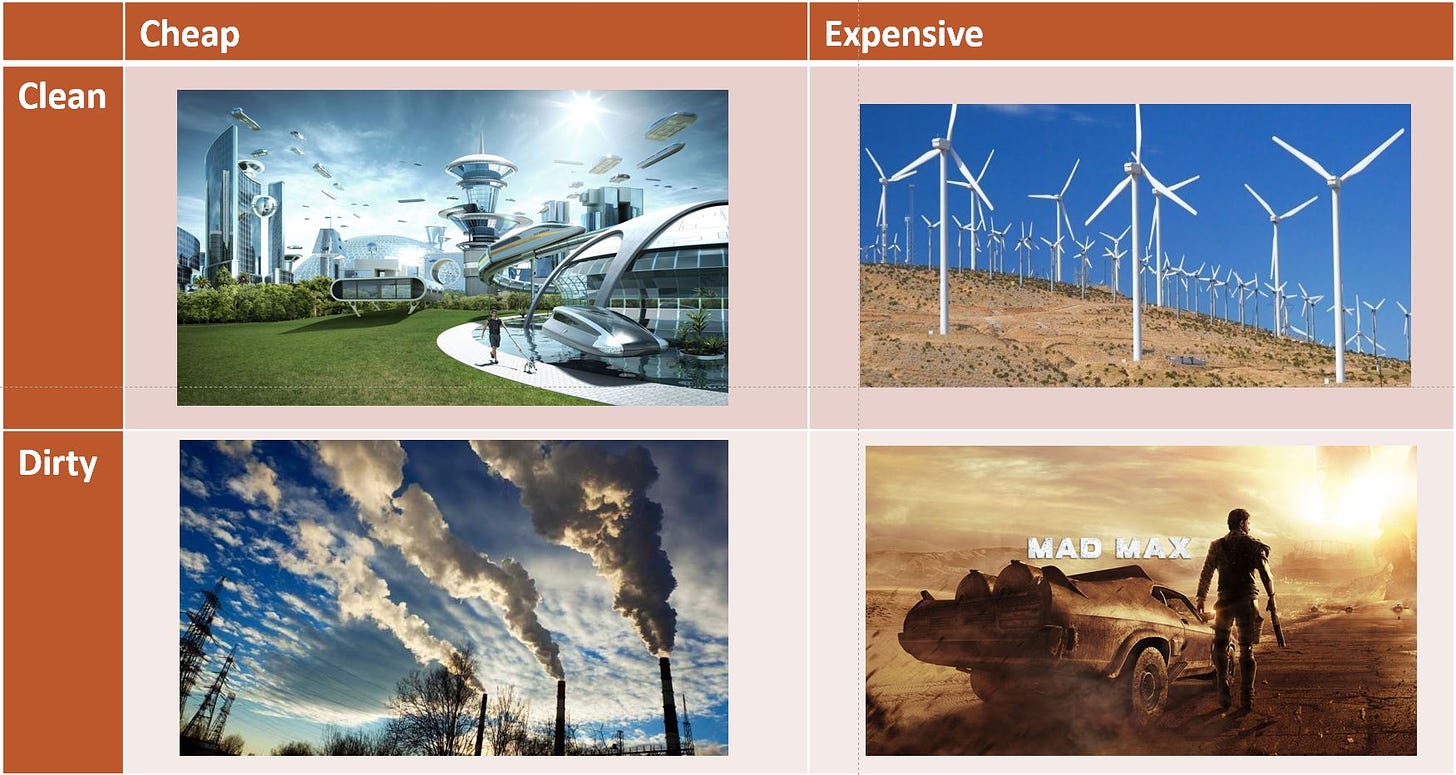

Given the 800bn barrel number above, one can question whether there will ever be a "low oil price" scenario as we go after more and more difficult to extract oil. My take on this is that these are not independent issues. Demand is unlikely to stay at 100mmbbls/d simply because it will be come unaffordable - and that spells economic decline.

As much as I do not see renewable energy as being a panacea for climate ills, I do see it as having a role (although nuclear has a much better case) in delaying the day we have to reckon with too-expensive oil and the end of the “carbon pulse”.

To my way of thinking, a “clear and present danger” is the feel-good drive to defund O&G. Attacking supply when demand shows no sign of abating (other than in spreadsheet analyses) is a potentially very destabilising and dangerous policy. The counter-argument is that encouraging O&G is destabilising and dangerous because we will all die in Hothouse Earth.

My question is which will come first (and no, breathless media reports attributing extreme weather to climate change are not supported by the science)?

A poorly managed Energy Transition has a Mad Max potential - demand for polluting energy which comes at high cost.

One way to ensure we do deploy enough capital to try and meet this resilient demand is to have market price-signals that encourage the needed investment. Love them or hate them, worry about a New World Order, but OPEC are trying to keep oil in a price range that does not lead to catastrophic shortfalls, price spikes and economic mayhem. Maybe they are doing this in their own self-interest, but it is nonetheless a service to all modern industrialised societies, whether we like it or not.

Never gonna give you up

Never gonna let you down

Never gonna run around and desert you

Never gonna make you cry

Never gonna say goodbye

Never gonna tell a lie and hurt you

Rick Astley

I think people have been misled by the easy ability to print paper. When a country runs a trillion dollar deficit..well, 800 billion doesn't look so big.

But we can't print molecules the way we print paper money.

The supposed miracles of the "could" grid (the grid we "could" have if we only had the "willpower") has been one of the ways we have fooled ourselves.

Very good, despite the frightening implications of the content.