North America (Mexico, USA and Canada) produces more oil and gas than it consumes. This is a radically different energy equation that the USA’s oil-import economy of the 1980s, 1990s, and 2000s, in which the foreign-policy dog was wagged by the oil-supply tail. Whilst oil imports were critical – Pax Americana was essential. What would happen if the USA stops acting as the global policeman? Why should US tax-payers fund a military that is keeping Middle Eastern oil flowing to China?

Weaponization of Oil

During the night of 14th October 1973 at a critical juncture of what is now called the Yom Kippur War, Operation Nickel-Grass was actioned. American C-141 and C5 transport planes were reported at Israel’s Lod airport unloading critical military equipment. Eight days earlier, Israel had been attacked simultaneously by Egypt, Syria and a broader coalition of forces. By the 14th, the war was going badly for Israel and the Moscow-backed pan-Arab solidarity was high.

The US military support turned the tide of the war in Israel’s favour but caused outrage in the Arab countries.

For the first time, oil was weaponized.

On 19 October, nearly two weeks after Egypt's Operation Badr, the United States pledged to support Israel's fight against the Arab countries. Earlier, the Organization of Arab Petroleum Exporting Countries (OAPEC) had reached an understanding to use the "oil weapon" https://en.wikipedia.org/wiki/Operation_Nickel_Grass

Whilst the Yom Kippur War was part of the bigger Cold-War struggle for power and influence, the Oil Embargo was new. Supportive oil producing nations had multiple objectives, primarily to starve Israel of fuel, but longer-term to punish those who had supported Israel – specifically the USA.

From Global Leader to Import Dependence

At the start of the Second World War, the USA was the biggest oil supplier to both Germany and Japan. In fact the US was by far the biggest producer in the world. Saudi oil wasn't discovered until 1937. Ironically, its biggest export markets were Germany and Japan.

By about 1969, domestic production in the USA was peaking, but the modern economic and consumer juggernaut was only just getting started. The USA had a hidden weakness – a weakness that the oil embargo exposed and exploited. The embargo on sales to the US only lasted until January 1974, but the bigger consequence was the understanding that by controlling supply, the global price could be controlled, and this could be used to hurt the USA and western allies.

Oil traded for about $2/bbl in 1970, a decade later after the embargo, the formation of OPEC and the Iranian Revolution it sold for ten times that. The price of $20/bbl doesn’t sound earth-shattering today, but they key here is that the energy input into the booming Western economies increased by 10x in a few years. Imagine oil going from say $80/bbl today to $800/bbl in the next ten years!

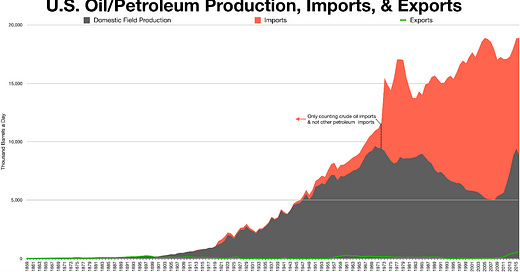

The natural reaction of the West was to reduce demand (a bit) and focus on increasing supply. The plateau of US production in the 1980s (seen in the above graphic) was due to considerable success in Alaska and the Gulf of Mexico. Globally, there were major contributions from the UK/Norwegian “North Sea” as well as the FSU. So much so, in fact, that prices crashed for a decade. The importance of domestic supply was not lost on law-makers.

In response to the embargo and higher domestic gasoline prices, Congress passed the 1975 Energy Policy and Conservation Act, which directed the president to ban crude oil exports except for select types of oil. (source)

The World’s Policeman

Despite the increased domestic production and the export ban, the fast-growing USA becoming increasingly reliant on imported oil. However, the global glut and consequent cheap prices allowed the memory of the “energy crisis” of the early 1970’s to fade. The fall of the Soviet Union and peace agreements in the Middle East led to a period of relative calm and economic prosperity. Notwithstanding this, the USA recognized its oil addiction and took on the role of the “World’s Policeman” – specifically keeping shipping lanes in and around the Middle East open for trade. In parallel, there developed a symbiotic arrangement with major oil producing nations - petrodollars recycled into US made armaments.

The Sleeping Giant

In 2015 the Obama administration repealed the oil export ban. This was in many ways symbolic because the US was still a net importer, but reflected the increasing importance of the “light tight oil” coming out of the US shale plays.

The complexities of this would merit a long post all to themselves, but to simplify, the LTO is too light to be all used in US refineries - so either heavier crudes are imported and blended, or some is exported. Equally, the US benchmark WTI crude had a discount to the more international Brent price, which was in part due to the export limitations - the gap closed after 2015. (This gap was also partly due to specifics of the US pipeline/storage infrastructure). Since 2015, contrary to much conventional wisdom, the US shale has continued to boom. With production today at a historical high.

Whilst the USA is technically still an importer of oil, it is close to par on oil+natural gas liquids (NGLs). Moreover, North America (Mexico, USA and Canada) produces more oil and gas than it consumes. This is a radically different energy equation that the USA’s oil-import economy of the 1980s, 1990s, and 2000s, in which the foreign-policy dog was wagged by the oil-supply tail.

When oil imports were critical – Pax Americana was essential.

What would happen if the USA stops acting as the global policeman? Some ask why should US tax payers fund a military that is keeping Middle Eastern oil flowing to China?

After America

Whilst it is extremely unlikely USA will suddenly pull back from it’s role in keeping international trade flowing, it is important to note that absent oil, pretty much everything else comes to the US across the Pacific, not through the Middle East.

Separately, China may well have learned lessons from the USA’s 1970s energy crisis. Being dependent on imports of oil (and gas, and to a lesser extent coal) is a significant weakness for any would-be super-power. Stepping well outside my comfort-zone here, but there is reasonable speculation that one consideration moderating China’s designs on Taiwan is their continuing energy import needs.

In 2021 China imported 11.4 mm bbl/day - representing 74 percent of its oil consumption. As Paul M. Dabbar points out, “For comparison’s sake, the US imported only 40 percent of its crude oil during the 1973 OPEC oil embargo”.

So when we see breathless headlines about China’s global leadership in the energy transition; how they are deploying “more wind and solar than the rest of the world combined” etc. we should not be fooled into thinking that this is a Net Zero policy.

China is far better run (from an Energy Policy point of view!) and far more pragmatic than many Western nations. If China were to invade Taiwan, the most obvious retaliation by the West would be to try to limit the supply of oil and LNG. If I can see this, you can be sure policy experts in Beijing and Washington have been on this for many years. China can’t halt its growing energy demand and has been only moderately successful in exploring for more domestic oil and gas (indeed the chess-game in the South China Sea is likely more about hydrocarbons than about fishing).

As part of the planning - oil storage has been a focus - which is an interesting contrast to the US SPR shenanigans.

China has also been adding to crude oil storage capacity. The PRC strategic oil reserve now has about 290–370 mm bbl of capacity, and oil industry companies such as refiners Shandong Hongrun and Hengli have about 900 mm bbl of capacity. This storage capacity would afford China approximately 80 days’ worth of supplies that could be used to cover a reduction in imports in the event of a supply disruption. (Dabbar)

Thus, the clear plan is to limit as much as possible domestic demand for oil and LNG. More coal, more nuclear, more renewables, more EVs all help displace dependency on oil imports.

Crushing any and all competition in the manufacturing of wind and solar through subsidies and lower environmental standards has created enormous manufacturing scale and lowered prices. The single biggest beneficiary of selling lots of wind and solar machines to the West, is of course, China itself: jobs, GDP and consequently the ability to deploy huge volumes of renewables to help displace oil imports.

We worry that renewables impose extra costs on existing electricity generation systems and we worry about the reliability of our grids as thermal plants are shut prematurely. Cost is not an issue if you think that you may potentially be facing a rupture of your oil supply lifeline, and wind and solar can contribute to energy security. Specifically though, cost is not an issue if your foreign policy is about making a historical legacy:

The thesis of this article is that President Xi has a strategic window, in the 2030 timeframe, when favorable conditions exist to forcefully annex Taiwan if peaceful unification is not achieved before then. This hypothesis is based upon the fact that an emboldened China intends to fulfill its strategic intent and imperial objectives through expansionist behavior against Taiwan. The three main factors examined are (1) President Xi’s “cult of personality” as a totalitarian leader to support the why of an invasion timeline, (2) the PLA’s defense modernization as an enabling planning factor, and (3) Chinese demographics against the backdrop of domestic election cycles and President Xi’s life expectancy. (The Ambitious Dragon: Beijing’s Calculus for Invading Taiwan by 2030)

The fact that China is deploying huge amounts of wind and solar has little political relevance to the West’s “Energy Transition” mania.

This is a Sign

As I have speculated previously (The World in 2040, Part II), North America could (very theoretically!) pull up the draw-bridges and sit behind the Atlantic and Pacific moats. It could be self-contained for energy, agriculture, mining, manufacturing, finance and water. I don’t think this is likely, or indeed possible, given the deeply interconnected world we live in. Having said that, we can watch for signs. Reshoring of critical industries - from mining to semi-conductors would be a sign. From an energy perspective, signs of a more inward-looking USA would be limitations on energy exports.

The recent proposed (then overturned) LNG export “pause” by the Biden administration was a “climate initiative”, not an energy security one, albeit with a similar outcome. A possible Trump administration has clearly indicated a desire to disengage on many “foreign policy” issues.

Will we ever see another oil export ban? Will we see the US pulling out of policing the Middle East trade routes? If we do, all bets are off.

In the meantime, and to answer my own question “Why should US tax payers fund a military that is keeping Middle Eastern oil flowing to China?” - I would suggest that the USA will continue in this role as it gives leverage/optionality in the event of any expansionist play by China. The world’s need for Taiwan’s semiconductor business is probably its best defence.

Great observations and questions.