The pictures coming out of Paris are not pretty, rubbish piling high, protests blocking roads and rail, and historic buildings on fire. All this because President Macron has tried to raise the “earliest” retirement age from 62 to 64. Knowing it wouldn’t pass in a legislative vote he used his presidential powers - which was never going to be popular. Whilst 62 isn’t the lowest in Europe it is in the “earliest” third, and in practice, people retire closer to 64 anyway (the European average is 64.5).

Whilst this is a deeply political debate about workers’ rights and political decision making - it is also part of a broader trend in demographics, economics and cost of energy. Let’s dig in.

Demographics

The French retirement system is not one of “saving” for your individual plan (as per 401k in the US and similar contribution systems in the UK and Switzerland), nor is it a managed pool of capital - it is basically airmiles.

As you work your career you earn points - which are redeemed at retirement. The cash payments retirees receive come from a payroll-tax on those working today. (NDLR: there is a “reserve fund” which is a managed pool of capital - but pension payments are dominated by the payroll-tax)

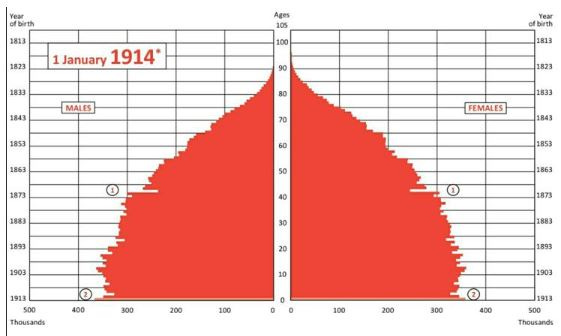

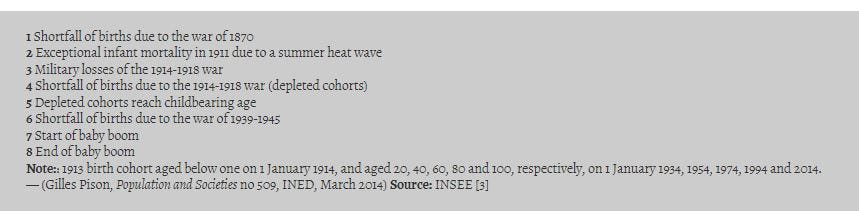

One can see how this looked like an attractive proposition when the age pyramid had more young than old, and older people had low (remaining) life expectancy.

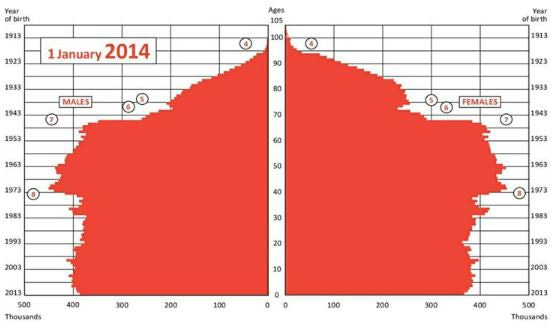

Fast forward and the population pyramid has the Baby Boom generation moving into a long retirement period and a smaller working population on the hook to pay for the current retirees. You can hear the arguments of the young - “its not fair” (which it isn’t) and of the retirees -“its not fair to touch our rights, we have paid into the system all our working lives” (which is also valid and true).

Had the economy been in dynamic growth, the burden might have been manageable even with a smaller working population contributing. But as we know, European economies are basically stagnating - and the energy crisis of 2021-22 has hit hard.

Even if generous state spending went into helping the elderly, there isn’t enough tax income to cover other government expenditure and the cost of retirement. This point has been robustly argued by Macron’s ministers but falls on deaf ears - with calls for a “wealth tax” (a bit ironic given that France already has one) and easy sound-bites such as “there is plenty of money, its a question of choice”.

Economics

Whilst France has a very visible problem - those with private pensions and publicly managed pension pools are not immune.

Pension fund managers have a singular (fiduciary) duty to grow the assets under management. There are funds specifically marketed as having a social agenda (not investing in tobacco, armaments and increasingly fossil fuels). The vast majority do not have a social mandate - but increasingly fund managers of both public and private money have taken it upon themselves to integrate “stakeholder” views and to allow their personal/political convictions to have a voice. Even forming vast “trillion dollar” cartels to Save the Planet. Indeed, when you look at the CEO of a company doing their utmost greenwashing - it will be because the board and ultimately the shareholders have laid out the direction of travel.

The rise of activist fund managers has led to many funds missing the huge rise in energy equities over the last 2-3 years, and then serious back-peddling to try and find “wiggle-room” to get back into the sector they had sworn off. A few years ago I asked, somewhat rhetorically, as to when the first class-action suit would be filed by disgruntled pensioners. Such a scenario was unlikely whilst the free-money bull-run in tech stocks made even mediocre asset managers look god-like. You could virtue-signal out of energy AND make a killing on growth stocks.

That era is over, and the hard yards are ahead. In a period of historically low inflation pension pools struggled to keep up. With inflation now in mid-high single-digits the challenge is much greater.

Anecdotally, the failed SVB bank has been accused of having had too much focus on social and climate agendas and not enough on basic banking risk management. This might just be name-calling, but is part of a larger trend.

Energy

The rising cost of energy has applied pressure to already struggling economies, and forced some governments to consider unprecedented austerity measures in order to keep their economies afloat. France is no exception despite having its robust nuclear fleet. By an unfortunate coincidence of timing the nuclear backbone weakened just when the continent needed excess electricity. France became an importer just when prices skyrocketed. Of course, electricity is only a small part of a country’s energy bill and France has to import all its oil and gas. Importing energy is a significant cost to any country’s budget. Macron’s decision to push the earliest retirement age up is part of a broader effort to manage government spending in the face of multiple demands and stagnating tax revenues.

The Ties That Bind

What is a Pension Plan a la Française? In simple terms it is nothing more than a promise - a promise that if you pay now, you will be looked after when you retire - which is obviously a very deep social contract. This goes a long way to explain the anger in the streets over something which objectively looks quite small (62 to 64 for a generation who will live 10-15 years more than their forbearers). By upping the retirement age the government is breaking a promise. Ironically there is a lovely/cynical expression in French that is “Les promesses n'engagent que ceux qui y croient” - which I would loosely translate to “Promises only bind those who believe in them”- or “if you believe in promises that’s your problem…”

Is a dream a lie if it don't come true, or is it something worse? (The River, Springsteen)

Can’t Pay, Won’t Pay

Another way of looking at state pensions is that it is a debt - a debt created by a promise not by a loan contract. State pensions are an implicit debt rather than an explicit one unlike, for example, foreign borrowing.

When energy costs increase and economic growth slows, stagnates or reverses - the pot of money decreases. The UK discovered this under Theresa May’s short tenure as PM - and when there is not enough money for everything hard choices have to be made. Borrow and invest in the hope of more growth and future debt repayment? Or the dreaded “austerity” which reduces spending but obviously also services. Cutting services is politically sensitive - it is very tangible. Not paying external debts is a no-no because it hurts your “credit rating” and excludes you from the future debt market - just like for an individual…

Meanwhile the liability of the pension system is increasing as a population bulge passes into retirement and those people live longer. So the stealth approach is to try and finesse the implicit debt of the retirement obligations. The mismatch between expectations and fiscal possibilities will be fudged and the problem will be pushed a few years down the road. However, it won’t go away, and is just one part of the decline of Europe.

Given the above it is amazing that European governments didn’t simply let Covid rip into the elderly populations. Politicians are cynical, but clearly not THAT cynical.

Excellently explained. I offered a policy solution for Oregon’s abysmally funded PERS several years ago, but, as a one-party state, the empty promise of retirement and government solvency is anyway one we have made only to ourselves and only for as long as we live here or are a government employee.

Always so nice reading you my friend. I agree with most maybe everything you say ! Take good care. Christophe N. (French !)