This morning gas priced in European spot market at the equivalent of $600/barrel. Oil briefly touched $139/barrel and in less than a week petrol prices at the pump have jumped 30%. Gas and Oil and are now front an center, Energy Security is front page news - and there is a growing realization that Energy Security and Energy Affordability are two sides of the same coin.

Whilst there is a lot of focus on oil and gas, its clearly not gone unnoticed that Ukraine and Russia are two of the world’s biggest producers (and exporters) of wheat. In fact there is a long list of commodities that are being affected, or will be.

What do high prices mean?

There are two effects :

(1) For inelastic demand - which for many people may mean commuting to work, heating the home etc - people will spend more of their household income on energy. This will be manifest as direct costs such as petrol (gasoline) and heating and then indirectly via embodied energy in all goods and services. Did I mention inflation?

(2) For elastic demand, or when prices are so high that inelastic demand gets hit also - there will be less consumption of energy (and goods and services). This is the famous “demand destruction”.

A higher proportion of income spent on basic essentials and the next level of “nice to haves” becoming more expensive means that the “disposable income” used for luxury purchases will be squeezed across vast swathes of the population. This will lead to more prudent spending - maybe not replacing a smart-phone so often, eating out less often, delaying purchases. Without repeating myself on the Paradox of Thrift, here I would just like you to think about how this will impact the value of businesses that rely on this “surplus” cash. There is an inverse correlation between energy costs and the value of businesses who rely on discretionary consumer spending.

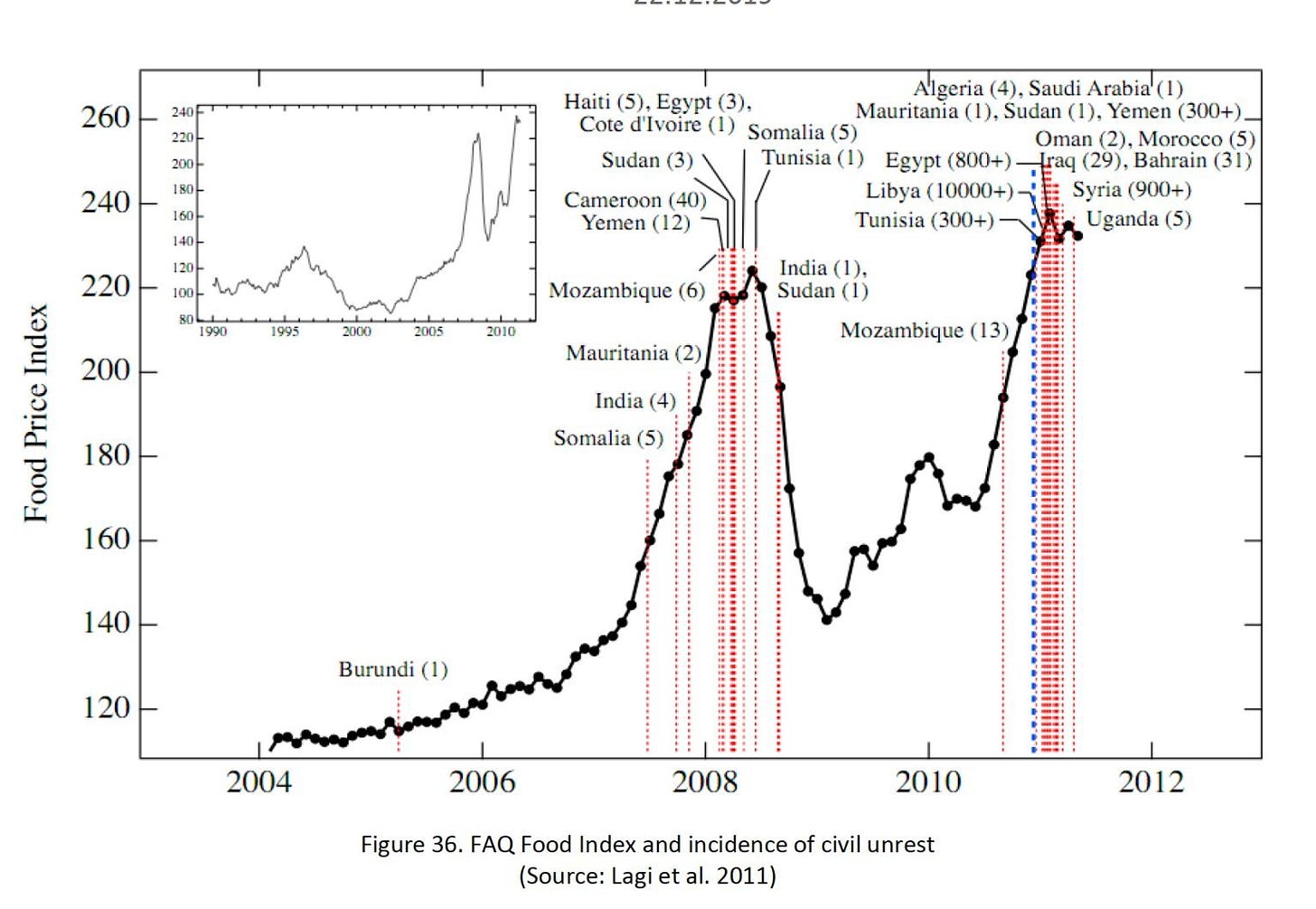

With respect to the second point - lets step away from OECD consumers and our mild inconvenience of higher prices. These markets are global - and poorer societies are disproportionately impacted by high prices. Demand destruction happens here first. Simply put when there is less supply than demand - some people, those who can’t afford the increased price go without. The problem here is that the things being priced out of reach are essentials - primary energy and food and fertilizer. This should be of great concern.

Extraordinary times call for extraordinary policy.

Europe, the US and allied nations should be prepared to reduce consumption to enable harsher sanctions on the aggressor - specifically on oil and gas.

However “painful” this will be it will be nothing in comparison to the real pain in Ukraine.

In addition, rationing of energy in our countries will help those who would otherwise drop off the bottom of the poverty ladder, simply because we could pay more.

Coincidentally as I am writing this I have had a conversation with DRW (or his cousin, I’ll never know). He evoked the fact that we managed to reduce global oil consumption by 8% with Lockdown 1.0 in March 2020.

Lockdown 2.0 to battle naked aggression is unlikely to happen, but at least now we know it is possible. Expensive, certainly, undesirable, definitely, but not impossible.