I published the following article on LinkedIn back in January 2020 - and am republishing it now given how much the world has changed. The current inflation in consumer prices and crash of the equity markets was not unimaginable. In fact, when you view the economy as an energy system, it was predictable and probable. Now where is my “I told you so” t-shirt ?

============================================================================

In game theory, the Nash Equilibrium, named after the mathematician John F Nash Jr. (of “A Brilliant Mind” film fame), is a proposed solution of a non-cooperative game involving two or more players in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only their own strategy. source

To this we can add that the observation that such an equilibrium is often sub-optimal for all players, but as noted in the description, no player has any incentive to change. Players are “locked in” to a sub-optimal outcome.

Energy Sucks

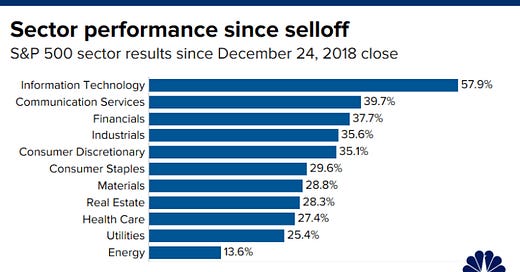

This sounds a bit theoretical but consider the current situation for fund managers investing equity. Over the last decade, “Energy” stocks, and in particular fossil-fuel ones have been the worst performing sector of any and all indexes. This is most extreme in the heart of the global financial machine in the USA. The reasons for this are complex, but fundamentally we can see that:

For coal, demand has tanked, collapsing share prices of producing companies, and driving many to bankruptcy.

Cheap gas has caused the demise of coal in the USA, but also hurt the gas industry itself. The transition has been driven by the availability of massive gas resources (both primary and associated gas), which have been so successfully brought to market that gas prices are borderline sub-economic for producers in many areas. A self-made glut (combined with global LNG glut) has collapsed the value of gas and the valuations of gas producing companies.

Likewise, for oil, despite increasing demand, the unprecedented growth in US shale has flooded the market and even with OPEC+ efforts, has caused "lower for longer" oil prices, which have in turn hurt revenues and valuations of oil stocks.

Is it any wonder that equity investors are massively underweight the sector? Add to this purely economic reasoning, the pressure to not be in such “vice” stocks and the investing thesis starts to have real momentum.

Meanwhile anyone who spurned the old energy stocks and has instead bet on momentum and/or consumerism, will have done very well. Shares in almost any consumer-facing company you care to think of have out-performed in this historically long bull run. Amazon, Alphabet, Apple, Netflix, Facebook etc. are all consumer facing – selling products, all have done incredibly well.

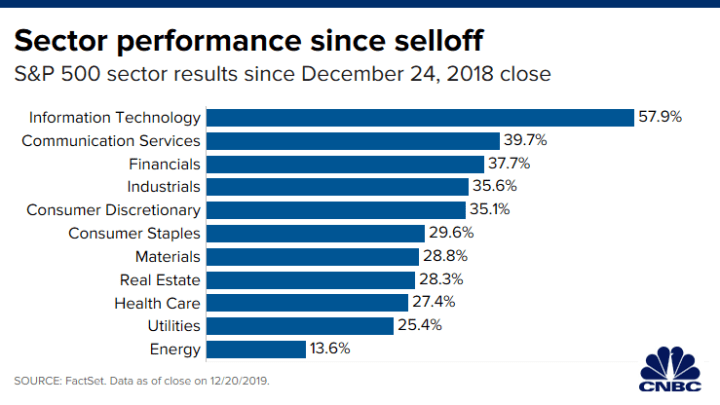

Equally, spurning old energy and investing in new energy has been a great bet. There has been a “virtuous cycle” in feel-good or “dinner party” stocks. Energy stocks, despite being cash generative performed worse than traditional "vice" stocks. (concept, analysis and image from SpareBank)

Blowing Bubbles

Policy incentives and ideology are driving money into clean energy, which apparently offers decent returns in a world bereft of good returns. The large amount of money looking for a “good” home makes a simple supply/demand effect on price. Virtuous stocks with a rising share price attract more money: as the share price risees, so the original drivers for investing become compounded by the momentum of the share price rise. Which of course attracts more money. This is not a unique case but is original in having the ideological driver on top of the more usual ones of momentum and greed. I think the technical term for this is “a bubble”.

Again, there is nothing particularly new or special about bubbles in asset classes or sectors or individual stocks. What is interesting in the current case is that energy is in whatever the opposite of a bubble is, and is treated as “just another sector” . The fact it is under-performing, that it is under-weigh, and that it is unloved is just what it is.

Nothing to see here, so please just move on.

The rational choice of “all” investors means that old energy is spurned whilst tech and services create wealth….

What could possibly go wrong?

The Greatest Trick

The rub of this of course is that the record equity bull-run has been underpinned by the very cheap energy that has caused the pain in the energy sector stocks. Cheap energy leads to more “disposable” income and cheaper goods and services. Whilst the effect comes from cheap primary energy, there is also a link back to monetary and fiscal policy – with the post-crash periods of QE injecting vast amounts of almost free money into the system. The glut of cheap energy in the US can be partly seen to be stemming from this. Ultra-cheap interest rates have allowed debt to be used widely and the concomitant lack of interest paying investments has allowed equity to chase yield. The net result has been a huge consumer boom. Not coincidentally, the rise of US shale (and the resulting over-supply of oil keeping energy prices low) has been at least in part fueled by mountains of cheap debt.

The greatest trick the devil ever played was convincing the world he doesn’t exist.

Energy is now so cheap and so plentiful that it is as if it doesn’t exist. The link between standard of living (and with it benefits such as long life-expectancy, low birth-rates, high quality of life, etc) and energy is forgotten. We should simply ban all fossil fuel usage… now.

The Economy as a Hurricane

One of the best ways to think of an economy is by analogy to a hurricane. It may be an unintended irony, but in the same way thermodynamics is the underpinning of our understanding of energy, so the concepts of thermodynamics can be used to understand the economy.

Hurricanes are intense low-pressure zones that are representations of gargantuan amounts of energy (by one estimation) a single hurricane can produce more than 200x the world’s total electricity generation capacity, but critically they are not self-sustaining.

Hurricanes form over warm tropical waters and can strengthen when heat-energy is an input. However, when they track over colder land or water, they lose their strength. Energy dissipates (as opposed to being concentrated) and the hurricane weakens until it is no more than a regular storm. This is a natural dissipative system; hugely energetic, potentially very destructive but essentially an ephemeral feature that needs energy inputs to sustain itself. In a similar way elements of social systems, and in this context, the global economy, can be seen to function in the same manner. Energy is the input that keeps the pot boiling. Remove the input and the system will dissipate energy and weaken. I'm not making this up... there is even a term for this, “ThermoEconomics”.

In the case of the economy, the simple analogy breaks down a bit here, because most rational commentators (at least those who have given it much thought) are not suggesting reducing the total energy needed by modern industrial society, but rather transitioning from a high carbon energy input (fossil fuels) to a low carbon alternative. The problem is of course that an economy needs to have surplus energy to continue driving the dynamics. If we transition from high EROEI energy sources to low EROEI sources, this is akin to transitioning from warm water to cooler water whilst assuming that it will continue to power the hurricane in the same manner.

What could possibly go wrong?

By starving the O&G industry of funding, we are setting up an economy (and an equity bull-run) that starts to look like a house of cards. When the inevitable supply-demand imbalance becomes noticeable, it will be too late for quick fixes. And although the US shale can be quite reactive on a rig-level view, the inertia is much greater at a macro scale. So even if it has the physical ability to supply vast quantities of oil, the cost of that oil will increase, and the “short-cycle” will be seen to be something of a mirage. To be reactive at the rig level, you need well-funded companies, and the funding having dried up will take time to come back. The same headwinds noted above (poor historical returns and climate-angst) will cause this inertia. In addition, you will need a rapidly expanding skilled work-force… many of whom may think twice before stepping back into this pond.

Whilst the investment community turns 180 degrees (away from crashing consumer stocks) at the speed of a laden supertanker, the supply gap will push energy prices into dangerous territory.

Inverted Yield Curves.

In the middle of last year, there was much chatter about how the US 10yr and 2yr Treasury yield curves inverted – and how this is a well-known leading indicator of an imminent recession.

I argued with colleagues that there would be no recession whilst energy prices stayed low – despite the scary heights of the stock indexes (and the parallel logic that at some point it simply has to crack). So far so good, the curves have reverted and nothing much happened on the recession front.

Whilst none of the crystal-ball economic indicators are absolute predictors, the relationship of rapidly increasing energy (read “oil”) prices has been a pretty good guide. This from the FT shows how it is not the absolute price of oil that trips the economy, but the cost of oil as a function of total GDP, here expressed as a percentage. Roughly speaking, when the world spends more than 5% of global GDP on its primary energy (and very energy dense) source, a recession follows.

When the next recession?

No idea, but hard to argue that it is not overdue.

But back to the main point – the sexy high-flying shares in today’s market all rely on cheap energy to fuel the necessary consumer storm. Many trillions of dollars not investing in fossil fuels (which still make up over 80% of the world’s power) will logically result in higher energy cost for everyone. So, by actively choosing to not invest in energy, the foundations of the valuations of consumer stocks is being undermined.

The Nash Equilibrium

Individually, asset managers make the rational choice to spurn old energy stocks and focus on the high-flyers. Collectively, however, there should be common cause to continue funding boring energy; if for no better reason than to preserve value in the other sectors. But of course it doesn’t, and won’t, work like this. The herd will continue making individually logical choices, and when the denouement comes it will almost certainly be unrecognized as being caused by the lack of investment in energy.

One big counter argument to this narrative is that there has been a fundamental shift in the economy and that a “decoupling” of GDP and energy input is occurring. From a thermodynamics point of view, this is like saying we are getting something for nothing – which doesn’t work in physical systems and almost certainly doesn’t in economic ones. In economic parlance, this is like saying “this time it’s different”.

A familiar phrase, and one that has never, ever, worked out well.